Long Term Capital Gain Rate 2024

Long Term Capital Gain Rate 2024. As the interim union budget looms on the horizon, investors are keenly anticipating updates regarding capital gains taxes—a critical. See how the gains you make when selling stocks will be impacted by capital gains.

Capital gains taxes on assets held for a year or less are taxed. You don’t need a massive amount of cash to get started investing in canadian stocks.in fact, $5,000 is a great starting point.

What Is The Capital Gains Tax?

If there is ltcg on listed securities (other than units) tax rate is 10% on.

The Total Capital Gain From Both Sales Is $2,500 (From Abc) + $12,500 (From Xyz) = $15,000.

You only pay capital gains tax if you sell an asset for more than you spent to acquire it.

The Calculation Is Simplest For Bonds And Equities As There Is No Role Of Indexation Benefit.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets For 2023, Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories.

Source: taxrise.com

Source: taxrise.com

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. As evident from the above chart, if the immovable property is held for a minimum period of 24 months before the date of its sale/transfer, the said.

Source: www.harrypoint.com

Source: www.harrypoint.com

ShortTerm And LongTerm Capital Gains Tax Rates By, The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. Hence, the net capital gain is rs 63, 00,000.

Source: marissawbritni.pages.dev

Source: marissawbritni.pages.dev

2024 Long Term Capital Gains Rates Alfie Kristy, The capital gains tax rate is 0%, 15% or 20% on most assets held for longer than a year. The calculation is simplest for bonds and equities as there is no role of indexation benefit.

Source: www.financestrategists.com

Source: www.financestrategists.com

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, The total capital gain from both sales is $2,500 (from abc) + $12,500 (from xyz) = $15,000. If there is ltcg on listed securities (other than units) tax rate is 10% on.

Source: www.wallstreetmojo.com

Source: www.wallstreetmojo.com

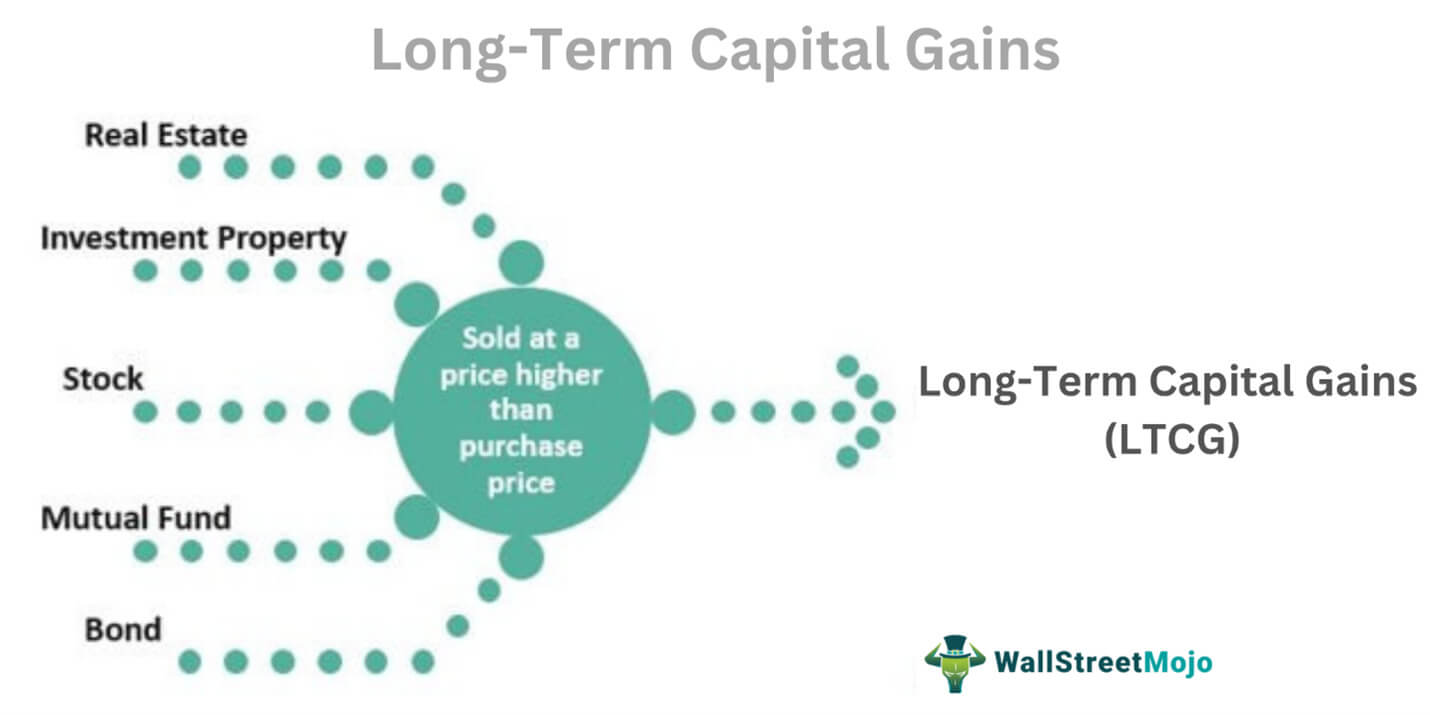

LongTerm Capital Gains (LTCG) Meaning, Calculation, Example, The calculation is simplest for bonds and equities as there is no role of indexation benefit. What is the capital gains tax?

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets For 2023 And 2024, This guide breaks down the tax rules and calculations for the fiscal year. Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent.

Source: taxfoundation.org

Source: taxfoundation.org

How High are Capital Gains Tax Rates in Your State?, You only pay capital gains tax if you sell an asset for more than you spent to acquire it. As evident from the above chart, if the immovable property is held for a minimum period of 24 months before the date of its sale/transfer, the said.

Source: 2022bty.blogspot.com

Source: 2022bty.blogspot.com

What Will Capital Gains Tax Be In 2022 2022 BTY, This guide breaks down the tax rules and calculations for the fiscal year. The total capital gain from both sales is $2,500 (from abc) + $12,500 (from xyz) = $15,000.

Source: www.moneycontrol.com

Source: www.moneycontrol.com

Budget 2023 Will longterm capital gains exemption limit go up?, You only pay capital gains tax if you sell an asset for more than you spent to acquire it. The irs may adjust the capital gains tax rate each year.

The Calculation Is Simplest For Bonds And Equities As There Is No Role Of Indexation Benefit.

The total capital gain from both sales is $2,500 (from abc) + $12,500 (from xyz) = $15,000.

A Few Assets May Be Taxed At Rates Higher Than The Typical 20%.

High income earners may be subject to an additional 3.8% tax called the net investment.