File 941 For 2024

File 941 For 2024. Organizations have until january 31 to submit this form, so the due date for reporting 2023 unemployment taxes, is january 31, 2024. Yes, must be filed with form 941 by the due date.

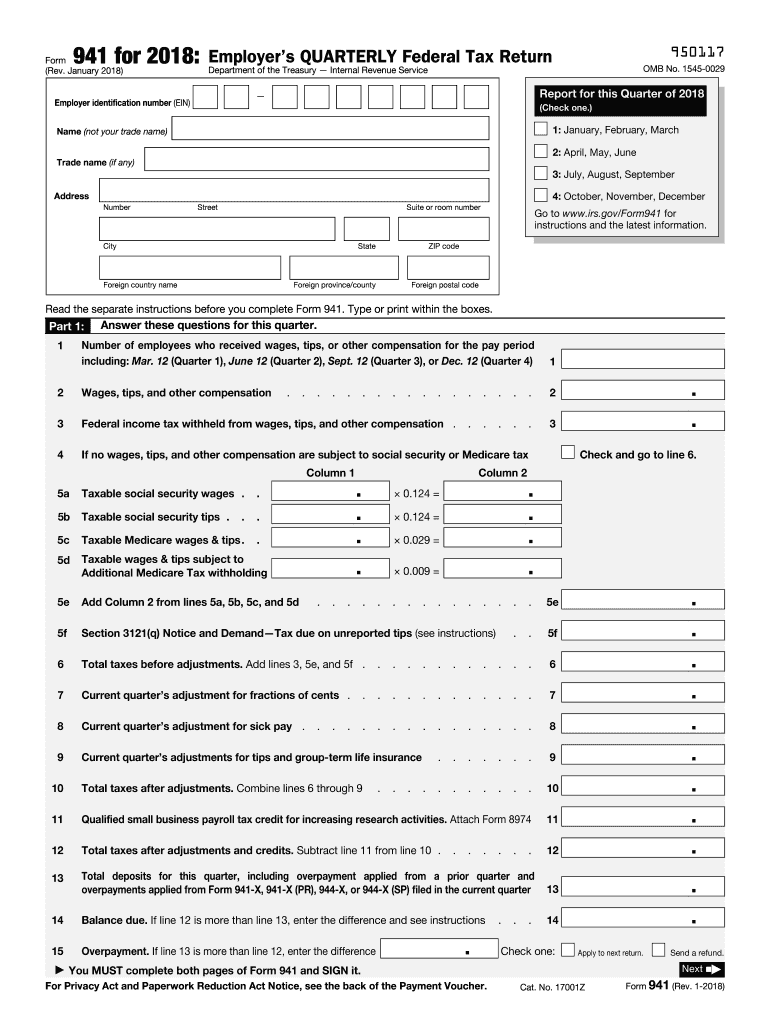

Irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. First quarter deadline — april 30, 2024 (january, february, and march) second quarter deadline — july 31, 2024.

New Tax Limits &Amp; Covid Credit Removal!

Form 941 is utilized to report the social security, medicare, and income taxes withheld from.

The 941 Deadlines For The 2024 Tax Year Are As.

The irs finalized form 941 and all schedules and instructions for 2024.

Yes, Must Be Filed With Form 941 By The Due Date.

Images References :

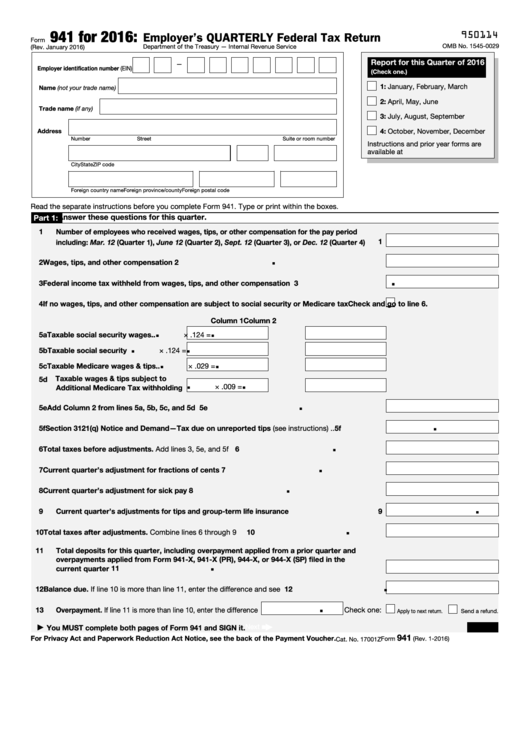

Source: ellynnqsibilla.pages.dev

Source: ellynnqsibilla.pages.dev

2024 Form 941 Instructions Addie Anstice, Essential updates for irs form 941 for 2024. Yes, must be filed with form 941 by the due date.

Source: printableformsfree.com

Source: printableformsfree.com

Free Download Fillable Form 941 Printable Forms Free Online, The 941 deadlines for the 2024 tax year are as. The revision is planned to be used for all four quarters.

Source: www.zrivo.com

Source: www.zrivo.com

941SS 2023 2024 941 Forms Zrivo, There are a few changes to form 941 that employers should be aware of before filing form 941. On january 24, 2024, you discover that you overreported social security and medicare wages on that form by $350.

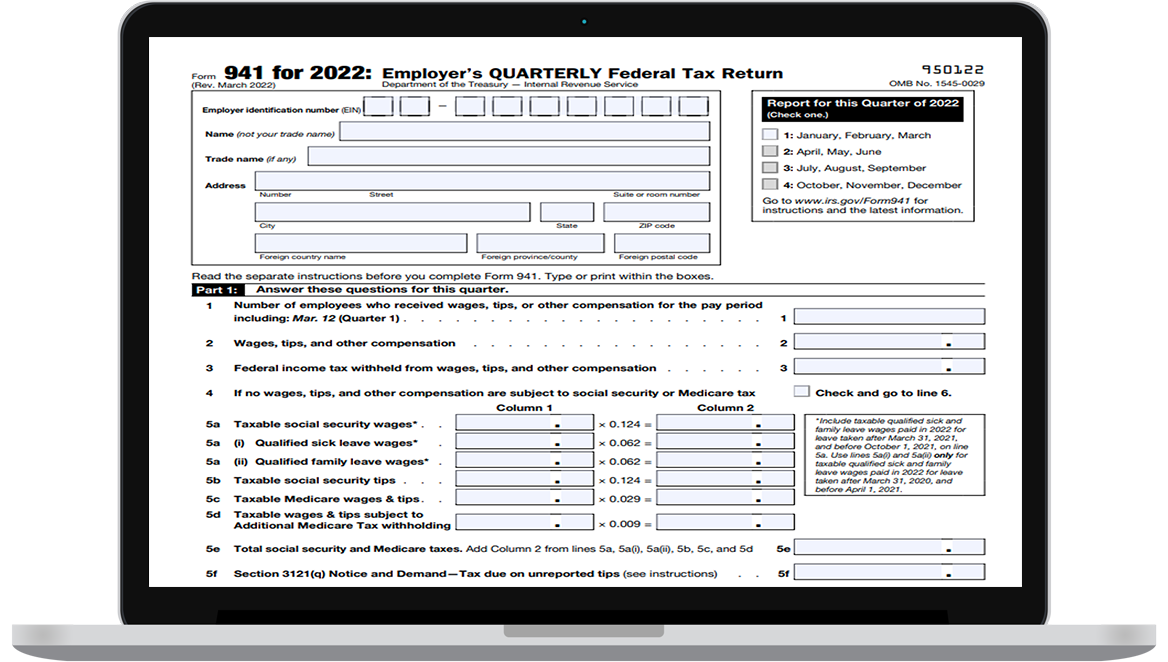

Source: www.form941electronicfiling.com

Source: www.form941electronicfiling.com

EFile Form 941 for 2022 File form 941 electronically, Schedule b, report of tax liability for semiweekly schedule depositors; The revision is planned to be used for all four quarters.

Source: www.youtube.com

Source: www.youtube.com

How To Efile Form 941 Late, Payments, Scorp) EMPLOYER, Mailing addresses for forms 941. File 941 online for 2024.

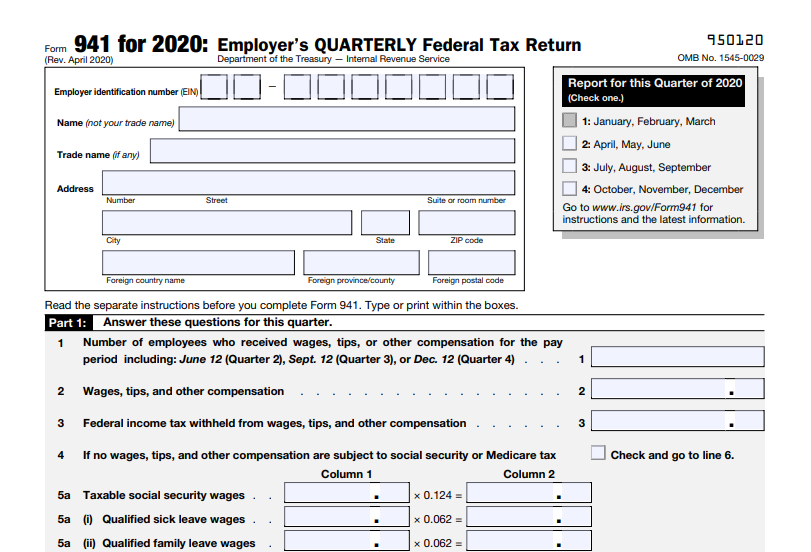

Source: www.paystubgenerator.net

Source: www.paystubgenerator.net

EFile your IRS Form 941 for the tax year 2020, The form 941 deadlines for 2024 are as follows: Rock hill, sc / accesswire / april 29, 2024 / the next business day, april 30, 2024, marks the deadline for employers to submit form(s) 941 to the irs.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Form 941 PDF is Watermarked "Do Not File" Page 2, The irs treats the return as if it were filed on april 15, 2021. When the deadline lands on a weekend or federal holiday, the next business day automatically becomes the deadline.

Source: blog.taxbandits.com

Source: blog.taxbandits.com

Today is the Deadline to File Form 941 for the First Quarter of 2021, Bulk upload data using excel/ csv templates; The irs released the 2024 form 941, employer’s quarterly federal tax return;

:max_bytes(150000):strip_icc()/Screenshot41-609c5062555746a19a271903137d39a0.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

IRS Form 941 What Is It?, Schedule b, report of tax liability for semiweekly schedule depositors; New tax limits & covid credit removal!

Source: dl-uk.apowersoft.com

Source: dl-uk.apowersoft.com

Free Printable Irs Tax Forms, Final versions of the quarterly federal. Bulk upload data using excel/ csv templates;

There Are A Few Changes To Form 941 That Employers Should Be Aware Of Before Filing Form 941.

New tax limits & covid credit removal!

Organizations Have Until January 31 To Submit This Form, So The Due Date For Reporting 2023 Unemployment Taxes, Is January 31, 2024.

Schedule b, report of tax liability for semiweekly schedule depositors;